When Are Maryland Business Taxes Due 2025

BlogWhen Are Maryland Business Taxes Due 2025. File your business' annual report and personal property tax returns, and pay local, state, and federal taxes. You must file & pay corporate income taxes in maryland by april 16, 2025.

You must file & pay corporate income taxes in maryland by april. Acceptance of maryland business income tax returns began january 16, 2025, and individual income tax returns began january 29, 2025.

Marylandtaxes.gov to the Office of the Comptroller, Acceptance of maryland business income tax returns began january 16, 2025, and individual income tax returns began january 29, 2025. 25 rows corporations operating in maryland and in one or more other states are.

Form 502d Fill out & sign online DocHub, What's new for 2025 (2025 tax year) filing season? Which employers had rates recalculated?.

Form 129 maryland Fill out & sign online DocHub, Acceptance of maryland business income tax returns began january 16, 2025, and individual income tax returns began january 29, 2025. Business income tax return dates vary.

Compare 2025 Tax Brackets With Previous Years Mela Stormi, See filing extensions and deadlines for corporations. If you make $70,000 a year living in wisconsin you will be taxed $10,401.

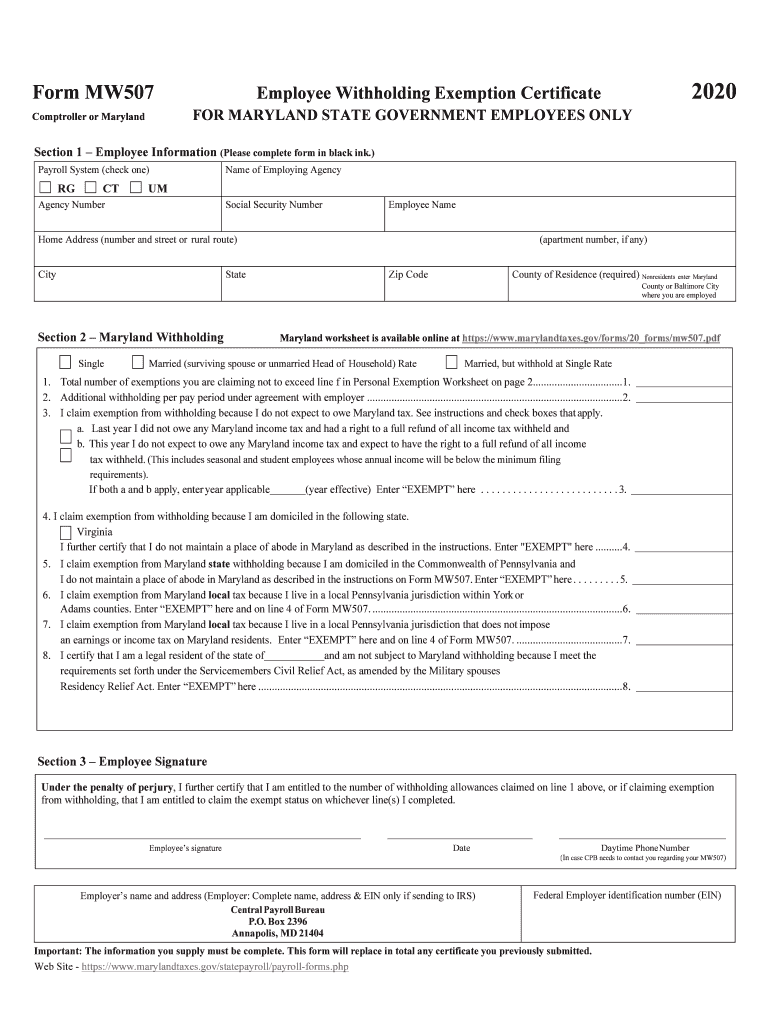

Maryland w4 Fill out & sign online DocHub, Edited by jeff white, cepf®. Daniel eggers, constellation’s cfo, received total compensation of $4.5 million, up 40% from.

State Corporate Tax Rates and Brackets Tax Foundation, Tax alerts, publications, and releases. That’s not the case for businesses though.

2025 Tax Due Date Buffy Ethelyn, Will my rate increase due to the recalculation? You must file & pay corporate income taxes in maryland by april 16, 2025.

/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg)

How Do I Do My Quarterly Business Taxes for My Maryland LLC?, Business income tax return dates vary. You must file & pay corporate income taxes in maryland by april 16, 2025.

Maryland form 202 Fill out & sign online DocHub, The maryland sales tax rate in 2025 is 6%. Here’s how much constellation’s other executives made in 2025:

Businesses in Maryland SDAT, How do i know if my rate changed due to the recalculation? Form used by recipients of annuity, sick pay or.

On wednesday, the maryland state department of assessments and taxation announced the state is extending the 2025 deadline to submit annual reports and personal property.